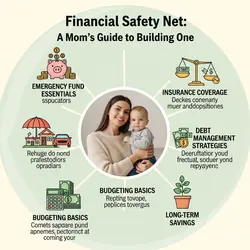

02:14 Financial Safety Net: A Mom's Guide to Building One |

|

I remember the day our water heater died. It wasn’t a dramatic, movie-style explosion, but a slow, silent leak that we discovered when I stepped into a puddle in our basement laundry room. My heart sank. With two young kids, the thought of no hot water for baths or dishes was a domestic disaster. But the immediate, gut-wrenching panic wasn't about the cold showers; it was about the cost. A new water heater was an expense we hadn't planned for, a giant financial boulder rolling right into our carefully managed budget. In my younger, pre-mom life, a moment like that would have sent me into a tailspin. It would have meant frantic calls, a maxed-out credit card, and weeks of financial anxiety, scraping by to pay it off. But on that day, something was different. After the initial "Oh no," a second, calmer thought followed: "It's okay. We have the safety net." That "safety net" – our financial cushion, our emergency fund – transformed a potential crisis into a manageable inconvenience. It was the single most powerful financial tool my family had ever built. It wasn't a fancy investment or a complicated financial product. It was a simple savings account, built slowly and intentionally, that stood between us and chaos. As a mom, my world revolves around creating safety for my children. We buckle their seatbelts, we hold their hands crossing the street, we put gates on the stairs. A financial safety net is just another form of that protection. It's the gate at the top of the financial staircase. It’s the invisible embrace that holds your family steady when life inevitably wobbles. I want to demystify it for you, mom to mom, and show you exactly how to build one, step by step. What is a Financial Safety Net, Really? (And Why You Desperately Need One) Let's get one thing clear: a financial safety net is not an investment. It's not for a down payment on a house or a family vacation. It is not money you are trying to grow. It is insurance. It's a pile of boring, easily accessible cash that has one job and one job only: to protect you from going into debt when life happens. And life always happens. It's the unexpected car repair, the sudden root canal, the leaky roof, or, in the most serious cases, a job loss. Without a safety net, these events force you to make decisions out of desperation. You might drain your long-term savings, rack up high-interest credit card debt, or even borrow from family, creating stress and strain that ripples through your entire life. A financial safety net is your buffer. It's your "peace of mind" fund. It gives you the power to handle an emergency with a clear head, making decisions based on what’s best for your family, not what your panicked bank account dictates. It is the difference between a stressful month and a devastating year. It is the ultimate act of financial self-care and responsibility for your family. Step 1: How Big Should Your Financial Safety Net Be? The "right" size for your safety net depends on your unique circumstances, but there is a simple rule of thumb that works for most families. The goal is to save 3 to 6 months' worth of essential living expenses. Don't let that number scare you. This isn't your total income. This is the bare-bones amount your family needs to survive each month if your income were to disappear. To figure this out, grab a piece of paper and add up your non-negotiable monthly costs:

Notice what's not on this list? Restaurant meals, new clothes, vacations, streaming services, or gym memberships. This is your survival number. Once you have your monthly total, multiply it by three. That is your initial goal. For example, if your essential expenses are $3,000 a month, your first target for your financial safety net is $9,000. If your job is less stable or you're self-employed, aiming for the six-month mark ($18,000 in this example) provides even greater security. Step 2: Where to Keep Your Financial Safety Net This is just as important as how much you save. The money needs to be liquid (meaning you can get to it quickly) but not too accessible. The Golden Rule: It must be in a separate account from your daily checking account. If it's mixed in with your everyday spending money, it will get spent. It will become the "oh, we can afford that concert" fund or the "let's just dip into it for new shoes" fund. It needs a dedicated home. The best place for your financial safety net is a High-Yield Savings Account (HYSA). Here's why:

Do not put this money into the stock market or any other investment. The stock market can go down right when you need the money most. Your safety net is for security, not for growth. Step 3: How to Start Building Your Financial Safety Net (Even When Money is Tight) Looking at a goal like $9,000 can feel completely overwhelming, especially when you feel like you're already stretched thin. I get it. But you don't build a brick wall all at once; you lay it one brick at a time. The most important thing is to start. 1. The "Baby" Safety Net: Your First $1,000. Forget the big number for a moment. Your very first mission is to save $1,000 as quickly as you can. This is your "starter" emergency fund. This amount alone is enough to cover a blown tire, a surprise dental bill, or a broken appliance. It will give you your first taste of that incredible feeling of financial security. Sell some things you no longer need, pick up an extra shift, or do a "no-spend" challenge for a month. Get intense and get it done. 2. Automate Your Savings. This is the secret sauce. The easiest way to save money is to never see it in the first place. Go into your payroll system or your bank account and set up an automatic transfer to your High-Yield Savings Account for every payday. It doesn't have to be a huge amount. Start with $25 or $50 per paycheck. The key is consistency. This "pay yourself first" method ensures your safety net is growing in the background without you having to think about it. 3. Find the "Extra" Money.

When (and How) to Use Your Financial Safety Net The day will come when you need to use your fund. The first rule is: no guilt. This is exactly what the money is for! It did its job. It protected your family. Use it only for true, unexpected emergencies. A flat tire is an emergency. A sale on a new TV is not. After you use some of the money, your next financial priority is to pause other savings goals (like investing or saving for a vacation) and focus on replenishing your safety net back to its fully-funded level. Rebuilding the wall is just as important as building it in the first place. Conclusion: The Gift of a Quiet Night's Sleep Building a financial safety net is a marathon, not a sprint. It takes time, discipline, and intention. There will be months you can save a lot and months you can barely save anything. That's okay. The goal is consistent, forward progress, no matter how small. The reward for this effort is something you can't put a price tag on. It's the quiet confidence that comes from knowing you can handle what life throws at you. It’s the ability to sleep soundly at night, even when the world feels uncertain. It’s the freedom from the constant, low-grade hum of financial anxiety. As a mother, giving that sense of stability and security to your family is one of the most profound and loving things you will ever do. It’s a legacy of peace, built one dollar at a time.

|

|

|

| Total comments: 0 | |